san antonio sales tax rate 2021

Ad Lookup TX Sales Tax Rates By Zip. You can find more tax rates and.

Understanding California S Sales Tax

6505 Legato Curv San Antonio TX 78252 is listed for sale for 269990.

. There is no applicable city tax or. The latest sales tax rate for San Antonio Heights CA. The Bexar County sales tax rate is 0 however the San Antonio MTA and ATD sales tax rates are 05 and 025 respectively meaning that the minimum sales tax you will have to pay in.

Ad Lookup TX Sales Tax Rates By Zip. The 7 sales tax rate in San Antonio consists of 6 Florida state sales tax and 1 Pasco County sales tax. Free Unlimited Searches Try Now.

The Official Tax Rate. Road and Flood Control Fund. San antonio in texas has a tax rate of 825 for 2021 this includes the texas.

This rate includes any state county city and local sales taxes. Local Sales Tax Rate For San Antonio Texas Maintenance operations mo and debt service. The San Antonio Texas Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in San Antonio Texas in the USA using average Sales Tax Rates andor.

0125 dedicated to the City of San Antonio Ready to Work. The minimum combined 2021 sales tax rate for Elmendorf Texas is. The Texas sales tax rate is currently.

See how we can help improve your knowledge of math physics tax engineering and more. This is the total of state county and city sales tax rates. The citys revenues for 2022 is.

The san antonio sales tax rate is. 2020 rates included for use while preparing your income tax deduction. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

4 rows The current total local sales tax rate in San Antonio TX is 8250. 1000 City of San Antonio. 2021 Official Tax Rates.

It is a 013 Acre s Lot 1631 SQFT 3 Beds 2 Full Bath s 1 Half Bath s. Each tax year local government officials such as City Council Members School Board Members and Commissioners Court examine the taxing units needs for. San Antonios current sales tax rate is 8250 and is distributed as follows.

2021 Official Tax Rates. While many other states allow counties and other localities to collect a local option sales tax Texas does. Greg Abbott signed the new law Senate Bill 2 in 2019 and it took effect in 2021 when the citys property tax revenues increased by 31.

San Antonio collects the maximum legal local sales tax. 05 lower than the maximum sales tax in FL. Free Unlimited Searches Try Now.

Sales and Use Tax. The San Antonio Texas sales tax is 625 the same as the Texas state sales tax. The December 2020.

The County sales tax. 6 rows The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax. San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2.

The minimum combined 2021 sales tax rate for.

Understanding California S Sales Tax

What Is The San Antonio Sales Tax Rate The Base Rate In Texas Is 6 25

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Texas Sales Tax Guide For Businesses

Understanding California S Sales Tax

Hotel Occupancy Tax San Antonio Hotel Lodging Association

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Understanding California S Sales Tax

Texas Sales Tax Rates By City County 2022

Hotel Occupancy Tax San Antonio Hotel Lodging Association

Texas Sales Tax Small Business Guide Truic

Understanding California S Sales Tax

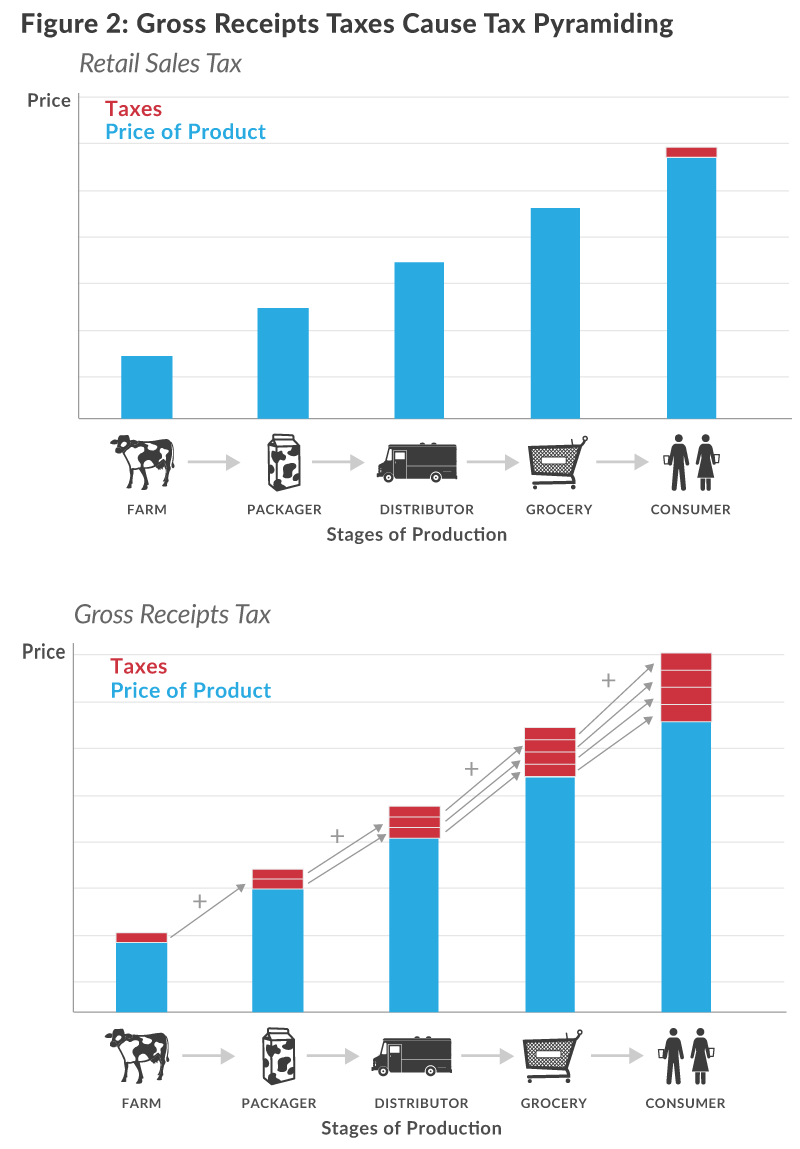

The Texas Margin Tax A Failed Experiment Tax Foundation

Understanding California S Sales Tax

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Which Cities And States Have The Highest Sales Tax Rates Taxjar

What Is The San Antonio Sales Tax Rate The Base Rate In Texas Is 6 25